State Senate Passes Bill Requiring Financial Literacy Course in Pennsylvania High Schools; PSBA Opposes Legislation

November 3, 2022

Earlier this month, the Pennsylvania State Senate passed Senate Bill 1243, which is designed to improve financial literacy in Pennsylvania by requiring High School students to complete a course on economics and personal finance in order to graduate.

According to a statement by State Senator Chris Gebhard (R-48), who sponsored the bill, “By teaching High School students the financial basics, they will learn necessary money management skills to position themselves for lifetime success and financial independence.” The bill outlines eight specific subjects that teachers of economics and personal finance must cover:

“(1) The true cost of credit. (2) Choosing and managing a credit card, including, but not limited to, the calculation of the annual percentage rate and compounding interest. (3) Borrowing money for an automobile or other large purchase. (4) Home mortgages. (5) Credit scoring and credit reports. (6) Planning and paying for postsecondary education. (7) Basic principles of personal insurance policies. (8) Basic principles of how to prepare and file Federal, State, and local tax returns.” (Senate Bill 1243)

In addition, the bill also requires that school districts support a professional development course for teachers and mandates that the course becomes a state requirement for High School graduation.

However, the bill faces significant opposition from students and school boards across Pennsylvania for a few main reasons. The first of these concerns is that the bill would add a new graduation requirement for High School students.

Violet Doyle, a junior at State High and a member of the Future Business Leaders of America Club, is against the bill based on the graduation requirement. “I don’t want it to get in the way of anyone graduating,” Doyle noted.

When asked if students at State High would support or oppose a requirement of this nature, Doyle remarked, “I think most would probably oppose it.” Then added workload and graduation requirements might also worsen the problem of the already prevalent mental health crisis in American schools by adding another graduation requirement on top of everything else students have to manage.

“I do think those types of classes are very helpful. I just don’t think it should be a barrier to graduation,” Doyle concluded.

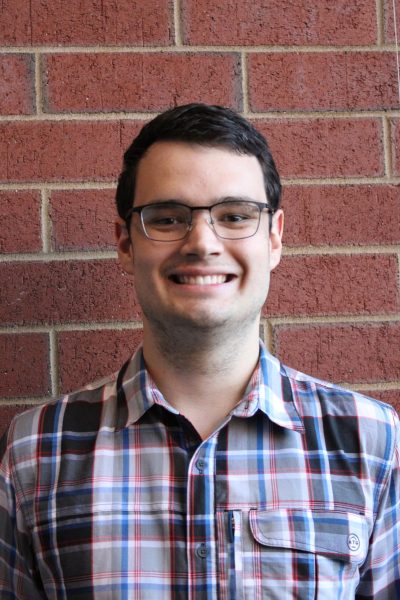

State College School Board President, Amber Concepcion, also supported financial literacy education but opposed any sort of mandate.

“I would certainly be supportive of a bill that required school districts to provide such a course, but I can’t support a bill that requires all students to pass this course in order to satisfy a graduation requirement,” Concepcion stated.

This is a position also taken by the Pennsylvania School Board Association (PSBA). Concepcion previously served on the PSBA legislative advisory committee, which reviews state legislation for its impact on school districts across the state.

With that expertise to draw from, Concepcion also notes the failure of the current bill to address the related issues of staffing and funding: On staffing, Concepcion noted, “If you were to require it, you’re talking about having to train a great deal of teachers, and you’d have to hire teachers to provide this program, which would cost money.”

On the cost to school districts, Concepcion stated, “The state’s not providing extra funds to meet the costs–that would be incurred to school districts from such a requirement. So, I think the state is really overstepping by requiring a program that they are not willing to fund.”

Although the lack of funding for the project undermines the bill, Concepcion does support financial literacy education more generally: “I think it is important for schools to provide courses in financial literacy though because it’s a really important skill set for students to have,” stated Concepcion.

State High currently offers a number of courses related to business and finance within the Business and Communications Community, including Personal Finance, which is offered every spring.

Jennifer Miller, a State High Accounting & Finance Teacher who also advises the Future Business Leaders of America, reviewed the proposed curriculum in the bill and wrote in an email that the content “is consistent with our curriculum here at State High.”

The bill now goes to the Education Committee in the Pennsylvania House of Representatives for consideration.